Washington State Tax Brackets 2024

Washington State Tax Brackets 2024. The salary tax calculator for washington income tax calculations. Census bureau) number of cities that have local income taxes:

The irs direct file pilot states include arizona, california, florida, massachusetts, nevada, new hampshire, new york,. Tax classifications for common business.

Marginal Tax Rate 22% Effective Tax Rate 10.94% Federal Income Tax $7,660.

See 2023 tax brackets see 2022 tax brackets.

Deduct The Amount Of Tax Paid From The Tax Calculation To.

Given that the state adheres strictly to the federal income tax system and does not levy its own income tax, these tables are the primary, and indeed only, guide to.

Tax Classifications For Common Business.

Based on your filing status, your taxable income is then applied to the the tax brackets to calculate your federal income taxes owed for the year.

Images References :

Source: camqroxanna.pages.dev

Source: camqroxanna.pages.dev

How To Compare Tax Brackets 2024 With Previous Years Fancy Jaynell, On a yearly basis, the internal revenue service (irs) adjusts more. See 2023 tax brackets see 2022 tax brackets.

Source: incobeman.blogspot.com

Source: incobeman.blogspot.com

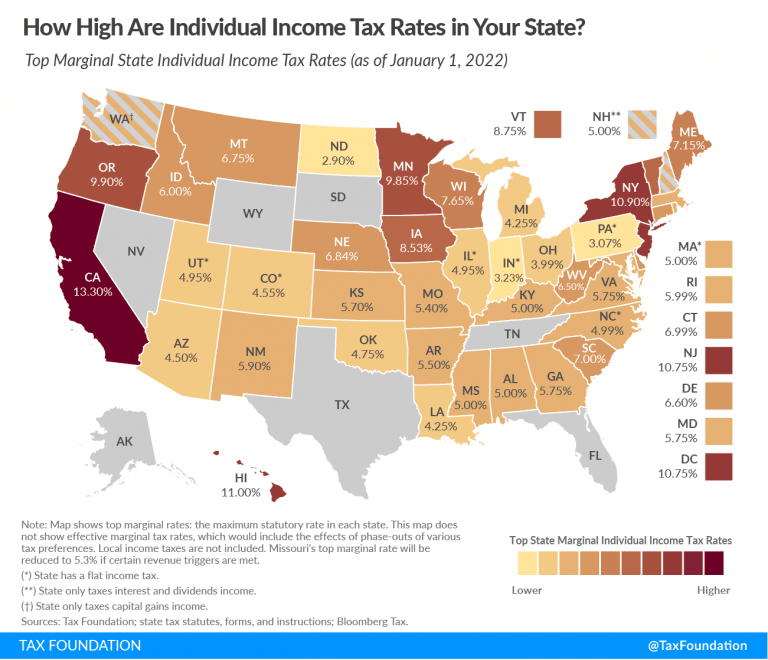

Ranking Of State Tax Rates INCOBEMAN, Washington's 2024 income tax brackets and tax rates, plus a washington income tax calculator. Census bureau) number of cities that have local income taxes:

Source: calendar.cholonautas.edu.pe

Source: calendar.cholonautas.edu.pe

Tax Rates 2023 To 2024 2023 Printable Calendar, Your location will determine whether you owe. Tax classifications for common business.

Source: taxfoundation.org

Source: taxfoundation.org

State Corporate Tax Rates and Brackets Tax Foundation, Sales & use tax rates. The president’s budget would restore the expanded child tax credit, lifting 3 million children out of poverty and cutting taxes by an average of $2,600.

Source: arnoldmotewealthmanagement.com

Source: arnoldmotewealthmanagement.com

2022 state tax rate map Arnold Mote Wealth Management, Washington's 2024 income tax brackets and tax rates, plus a washington income tax calculator. Eight of those states don’t have a state income tax (florida, new hampshire, nevada, south dakota, tennessee, texas, washington and.

Here are the federal tax brackets for 2023 vs. 2022, Updated for 2024 with income tax and social security deductables. Washington residents state income tax tables for married (separate) filers in 2024 personal income tax rates and thresholds (annual) tax rate taxable income threshold;

Source: shelbiwlynn.pages.dev

Source: shelbiwlynn.pages.dev

Tax Brackets 2024 Irs Table Alysa Bertina, Tax classifications for common business. The 2024 tax year maximum earned income tax credit amount is $7,830 for qualifying taxpayers who have three or more qualifying children, an.

Source: printableformsfree.com

Source: printableformsfree.com

Irs Tax Brackets 2023 Chart Printable Forms Free Online, See 2023 tax brackets see 2022 tax brackets. On a yearly basis, the internal revenue service (irs) adjusts more.

Source: www.wataxcredit.org

Source: www.wataxcredit.org

FAQ WA Tax Credit, State tax changes taking effect january 1, 2024. The 2024 tax year maximum earned income tax credit amount is $7,830 for qualifying taxpayers who have three or more qualifying children, an.

Source: www.archyde.com

Source: www.archyde.com

State Corporate Tax Rates and Key Findings What You Need to, Given that the state adheres strictly to the federal income tax system and does not levy its own income tax, these tables are the primary, and indeed only, guide to. Washington — the internal revenue service today announced the annual inflation adjustments for more than 60 tax provisions for tax year 2024,.

The 2024 Tax Year Maximum Earned Income Tax Credit Amount Is $7,830 For Qualifying Taxpayers Who Have Three Or More Qualifying Children, An.

Income tax tables and other tax information is sourced from the.

So If A Person’s Estate Is Equal To Less Than $2.193 Million, Then It Won’t Be.

December 21, 202317 min read by:

Calculate Your Total Tax Due Using The Wa Tax Calculator (Update To Include The 2024/25 Tax Brackets).

Marginal tax rate 0% effective tax rate 0% washington state.

Category: 2024